Key points

- Pet insurance renewals: If you don’t make any changes to your pet insurance policy, you can expect it to auto-renew each year.

- Money-back guarantee: Most pet insurance providers offer a period of time during which you can get a refund, as long as no claims have been filed.

- Considerations before canceling: If you cancel your current pet insurance policy, you may not be able to have coverage for pre-existing conditions if you re-enroll later on.

While pet parents will do anything for their pet’s well-being, waiting to see how much your veterinary bills will come to can be stressful. After all, the cost of vet care, from consultations to medication to surgery, quickly adds up.

Many pet parents decide to enroll in a pet insurance plan as a way to help plan and prepare for costly veterinary expenses. Once you enroll in a pet insurance plan and the waiting period passes, your pet can have coverage for accidents and illnesses (or accidents only depending on the plan you choose.)

Once you have pet insurance, you may be wondering whether you need to renew it – or, if your needs change, how to modify or cancel your plan. We’ve put together the following guide to help you navigate this topic. We’ll tell you what to expect when it’s time to renew your pet insurance, discuss common cancellation policies, and more.

Let’s dive in.

What is pet insurance?

Pet insurance has grown in popularity in recent years. In 2022, the industry saw a rise in enrollment of 22.1%. Interestingly, NAIC reports that of insured pets, 80.1% are dogs, and 19.9% are cats. So, what is it and how can pet parents use it?

Pet insurance is an insurance policy that pays you back for a large portion of your eligible vet bills. If your cat or dog is injured or comes down with an unexpected illness, your pet insurance plan can help you afford the treatment they need to recover swiftly. While there are different insurance coverage types, two common options are accident and illness protection or accident-only protection.

With pet insurance, you’ll pay the vet bill up front, file a claim with your provider, and then a percentage of covered treatment costs will be reimbursed once the claim is approved. The amount you get back will depend on your deductible and your reimbursement amount.

Most standard policies exclude preventive care, such as dental cleanings, vaccinations, and spaying/neutering. If you want help paying for these services, you’ll need to enroll in a wellness plan or package.

Keep in mind that there are variations in terms and conditions in every policy. For example, if your pet has a pre-existing medical condition, it typically won’t be covered by most policies. There can also be waiting times, age restrictions, annual limits, and excess payments.

What are the benefits of pet insurance?

Healthy cats and dogs can live for 10+ years and often do live longer. The oldest dog ever, Bobi, reached a grand age of 31! With pets who will be by your side for many years, pet parents should be prepared for a long-term commitment to maintaining their pet’s health and well-being. Pet insurance can be one piece of the puzzle – helping you afford the best veterinary care possible.

Veterinary bills for the most advanced treatments and care options can be expensive. Pet parents in the US alone spend around $35.9 billion every year on veterinary care and product sales.

The right pet insurance policy can save you money over the years and keep you from having to make a difficult choice between care and cost. Pet insurance is also a helpful tool to have in place as you can typically use it at your preferred vet or any vet you choose, so your pet can get the best possible care from someone you trust.

Ultimately, pet insurance is there to give you peace of mind. If you enroll your pet at an early age, you can have coverage for unexpected accidents and illnesses that occur over their lifetime. It’s an investment in your pet’s health that’s worth it tenfold in the long run.

What should you look for in a pet insurance policy?

Not all pet insurance coverage is the same. Coverage can differ greatly from provider to provider and plan to plan. Before enrolling in a new policy, be sure to read the fine print to be certain it’s right for your pet. For example, some policies have breed restrictions and upper age limits, meaning your cat or dog may not be eligible. Also, most insurers won’t cover pre-existing conditions or pregnancy-related conditions.

A reliable and extensive pet insurance plan should give you coverage for a wide variety of accidents, illnesses, and treatments. Excellent communication should also be a priority. If you do need to make a claim or there’s an issue, you’ll want to speak to a real person for quick assistance.

Before you make your decision, check how easy it is to make a pet insurance claim. For example, can you do it online or over the phone? If you need to print or fax documents, consider whether that’ll be too inconvenient or time-consuming for you.

How do you renew your pet insurance plan?

When you enroll in a policy, your pet insurance plan will usually be set for one year. When the time is almost up, your pet insurance provider will send you a reminder that your policy is coming to an end. You’ll have time to make any changes and double-check the details for your next plan period.

Alternatively, if you’re happy to continue, your policy will usually auto-renew. There can be a few exceptions to this, however. If you’ve missed a payment or there’s an issue with a claim, action may be required. Bear in mind that year over year, premiums can increase due to a variety of factors.

Before your pet’s coverage renews, take a look at the policy documents. Your circumstances may have changed, and the policy may no longer be a good fit. For example, you may have adopted an additional pet who needs insurance, moved home, or experienced a change in your finances.

If you want to update your payment details, you may not have to wait for the policy to renew; your provider will likely allow you to do this at any time.

How do you cancel pet insurance?

While most insurance companies let you enroll online, canceling a policy usually needs to be done over the phone. Some may also allow you to give written notice of cancellation. Before deciding, chat with the provider to make sure this is the right choice for you and your pet. Make sure you get your cancellation confirmation in writing.

When you enroll in a new pet policy, some plans offer a window during which time you can get a full money-back guarantee. If you make a claim during that period, however, you might not get a full refund. There might also be a cancellation fee that applies.

You can cancel your pet insurance policy at any time, but you need to weigh up the pros and cons of doing this. The biggest consideration is your pet’s loss of coverage. If your cat or dog needs veterinary care when they no longer have pet insurance coverage, you might be hit with a large, unexpected veterinary bill. Or, if your pet develops a condition after your coverage starts, your next insurer will likely consider it pre-existing and could decline to cover it.

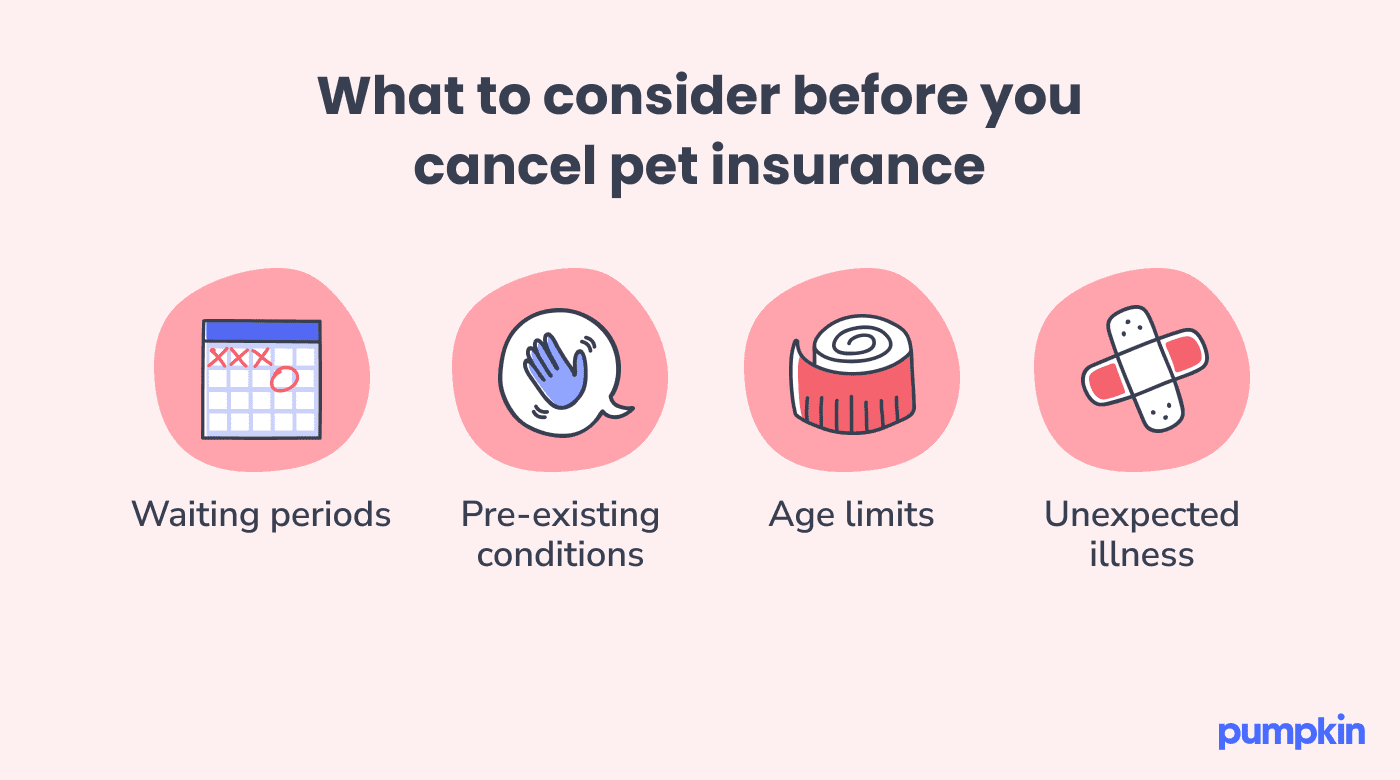

What to consider before canceling your pet insurance

If you’re thinking about canceling your pet insurance coverage, there are important things to consider.

Pre-existing conditions

This is arguably the biggest downside of canceling a pet insurance policy. Imagine your pet has had insurance for two years, and during that time has developed allergies and an ongoing digestive condition that requires regular medication. If you cancel your current policy but decide to re-enroll six months later, those conditions are now considered pre-existing under the new policy.

In short, if your cat or dog has already been diagnosed with an illness or health condition, these will typically be listed as exclusions when you enroll in a new policy. Canceling and switching companies means you might end up paying lower monthly premiums for a time — but now you have a lower degree of coverage.

It’s worth mentioning that some pre-existing conditions may be temporary and could be covered again after a waiting period. For instance, let’s say your pet had a broken leg from an accident in the past — another broken leg in several years would likely still be covered. In any case, your new insurance provider will usually ask you and your vet for your pet’s health history.

Waiting periods

If there’s a chance you’ll start a new policy either now or in the future, your pet typically won’t be covered immediately. Most insurers have a waiting period, but it can vary due to many factors: different providers’ policies; insurance laws in your state; your pet’s health conditions.

When canceling and choosing a new plan, keep in mind the length of this period that you have to wait before your pet has coverage. With certain providers, it can be up to six months for some conditions.

Age limits

Some companies have upper age limits for new policies. Why? Older pets tend to have more health conditions, so insuring them can be more costly for pet insurance providers. If your pet is getting close to their senior years, you always have the option to cancel your existing policy, but you might not be eligible for a new one if you change your mind down the road.

Some providers, like Pumpkin, do have plans with zero upper age limits, so you do still have options if you make the choice to cancel in your pet’s later years.

Unexpected illness

If you cancel your pet insurance policy, it does come with some risk. If your pet has an accident or illness during a time that they are without coverage, you must pay all of their veterinary bills out of pocket. If you have dedicated savings or other funds for pet health care, this may not be an issue. For many, however, a sudden vet bill in the thousands of dollars can be difficult and stressful.

Keep in mind that even the healthiest pets can still require veterinary care for unexpected accidents or illnesses. Whether it’s during a waiting period or after you’ve canceled your policy, make sure you’re prepared for unexpected issues that may arise.

Pet insurance renewal and cancellation FAQs

What else do you need to know? Here are commonly asked questions about pet insurance renewal and cancellation policies.

Check your specific provider’s policy terms because the rules can vary. In general, if you cancel within a certain period you can be reimbursed for your premium. This will likely not be the case though if you have claimed during that time. If you’ve paid your yearly premiums upfront and any money-back guarantee period has passed, you might get a pro-rated refund for the months still left on your policy.

If your needs change before your policy’s renewal date, you may still be able to change aspects of your coverage. For example, you may be able to add a new pet to your policy or you may be able to add wellness coverage – this additional coverage can reduce the cost of vaccinations, parasite screenings, and other preventive treatments.

You may be able to change your annual deductible or annual limit mid-policy or at renewal, but we recommend speaking to your pet insurance provider directly so they can advise you on what changes are available to you. Bear in mind that typically, you cannot increase your level of coverage mid-policy period or at renewal (such as increasing your annual limit.) Before deciding to make a change, take the time to fully understand how changing your policy may impact your pet’s coverage.

Yes, you can enroll in a pet insurance policy for each of your pets or cover multiple pets with the same plan. Different providers will offer varying options for multi-pet enrollment, and may even offer a multi-pet discount. For example, Pumpkin plans offer a 10% multi-pet discount for each additional pet you enroll.

The final word on renewing or canceling your pet insurance policy

If you’re happy with your policy and there are no changes to it, it’ll auto-renew each year. But you should occasionally review the details to make sure it’s still the right plan for your pet.

Want to cancel? Read your coverage’s cancellation policy first to know where you stand. Remember, there are a few things to consider before canceling your pet’s insurance coverage. Waiting periods, age limits, and pre-existing conditions can all impact future policies.

It’s important to know how losing coverage could affect your pet’s ability to re-enroll and receive coverage for their health conditions down the line. That said, you are the one who knows what’s best for your pet and your family, so feel empowered to make the decision that’s right for you.